PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS OF

HILLS BANCORPORATION

To Be Held on April 16, 201817, 2023

TABLE OF CONTENTS

| Page | |||||

| PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS | 3 | ||||

| INFORMATION CONCERNING NOMINEES FOR ELECTION AS DIRECTORS | 6 | ||||

| NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION | 8 | ||||

| NON-BINDING ADVISORY VOTE ON THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |||||

| INFORMATION CONCERNING DIRECTORS OTHER THAN NOMINEES | 9 | ||||

| CORPORATE GOVERNANCE AND THE BOARDS OF DIRECTORS | |||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |||||

| DELINQUENT SECTION 16(A) | |||||

| COMPENSATION AND INCENTIVE STOCK COMMITTEE INTERLOCKS AND | |||||

| COMPENSATION DISCUSSION AND ANALYSIS | |||||

| COMPENSATION AND INCENTIVE STOCK COMMITTEE REPORT | |||||

| SUMMARY OF CASH AND CERTAIN OTHER COMPENSATION PAID TO THE NAMED EXECUTIVE OFFICERS | |||||

| RISK MANAGEMENT AND COMPENSATION POLICIES AND PRACTICES | |||||

| AUDIT COMMITTEE | |||||

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |||||

| PROPOSALS BY SHAREHOLDERS | |||||

| BOARD NOMINATING PROCESS | |||||

| COMMUNICATION WITH THE BOARD OF DIRECTORS | |||||

| AVAILABILITY OF FORM 10-K REPORT | |||||

| OTHER MATTERS | |||||

HILLS BANCORPORATION

131 E. Main Street, PO Box 160

Hills, Iowa 52235

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

To Be Held on April 16, 201817, 2023

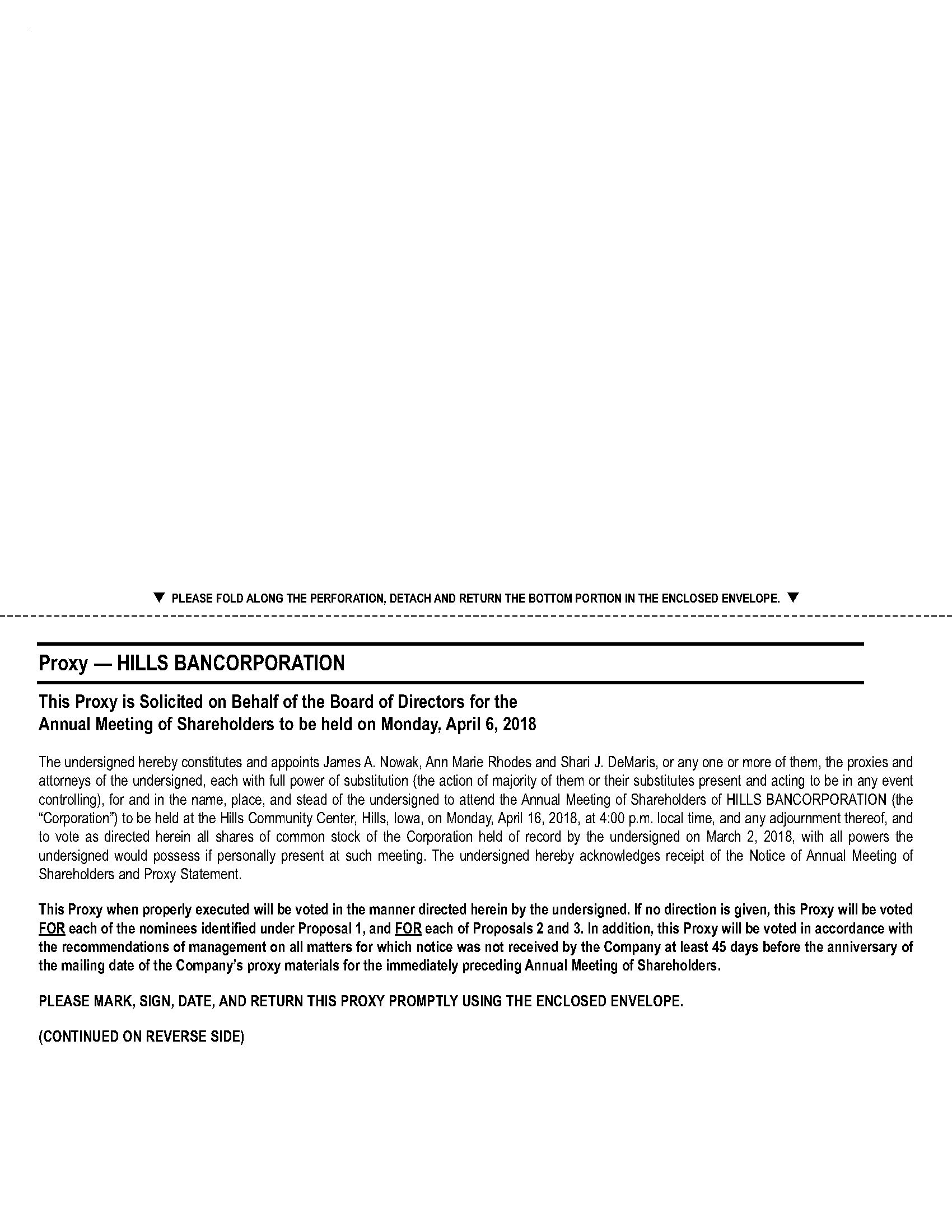

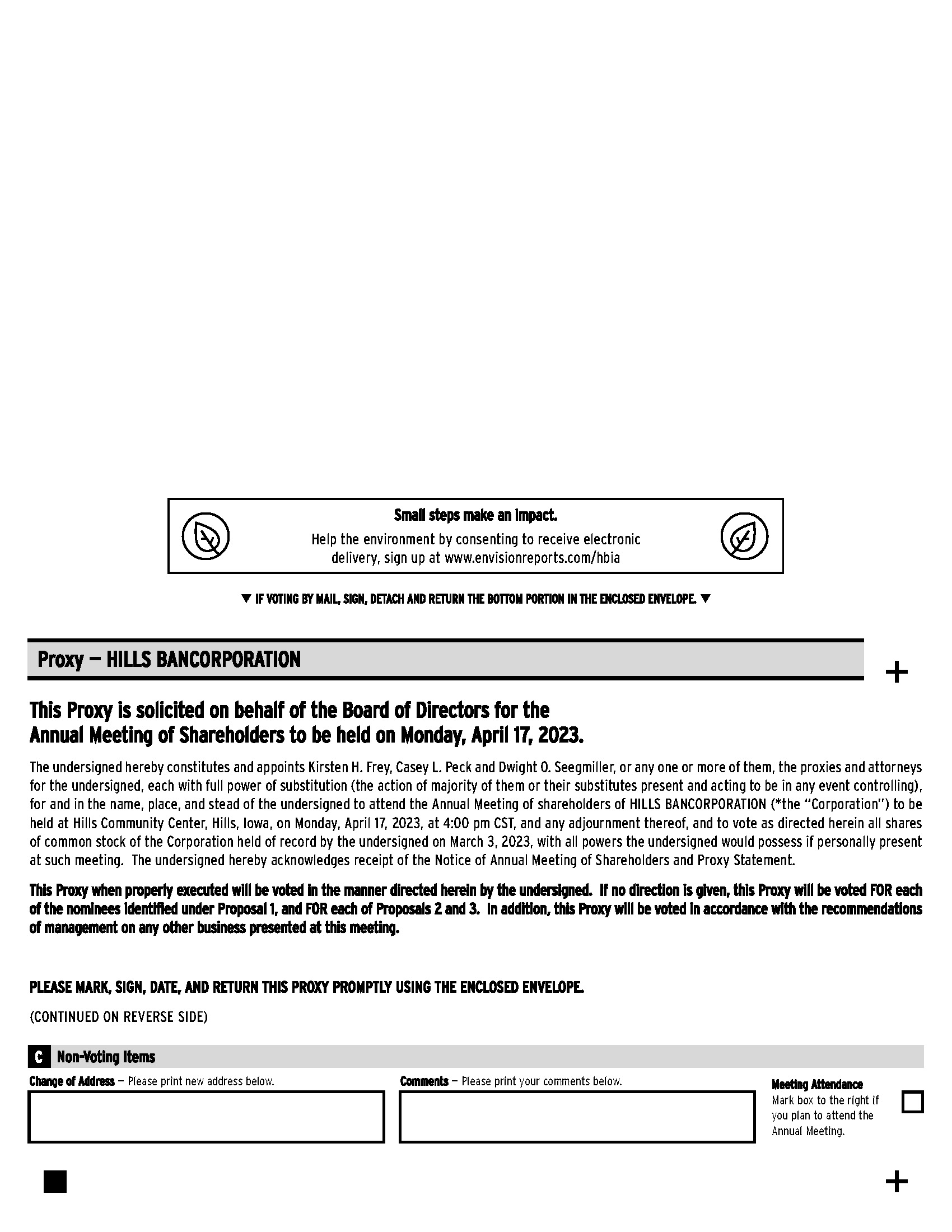

This Proxy Statement is furnished to shareholders of Hills Bancorporation (the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company for the Annual Meeting of Shareholders to be held at the Hills Community Center, 110 E. Main Street, Hills, Iowa, on Monday, April 16, 2018,17, 2023, at 4:00 p.m. (Central Time), local time, and any adjournments thereof. This Proxy Statement and form of Proxy enclosed herewith are first being sent to the shareholders of the Company entitled to vote at the Annual Meeting on or about March 16, 2018.17, 2023.

General Information about the Meeting and Voting Securities and Procedures

Who may vote at the meeting?

The Board of Directors has fixed the close of business on March 2, 20183, 2023 as the record date for the determination of shareholders who are entitled to notice of and to vote at the meeting. You are entitled to one vote for each share of common stock you held on the record date, including shares:

•held directly in your name; andand/or

•held for you in an account with a broker, bank or other nominee (shares held in “street name”).

How many shares must be present to hold the meeting?

The presence in person or by proxyat the meeting of a majority of the Company’s common shares entitled to vote at the Annual Meeting shall constitute a quorum for purposes of holding the meeting and conducting business. On the record date there were 9,423,4229,219,336 shares of the Company's common stock outstanding, which amount includes unvested shares of restricted stock entitled to voting rights. Each of the holders of the outstanding shares and restricted stock grants, totaling 9,423,4229,219,336 shares, are entitled to one vote per share. Your shares are counted as present at the meeting if you:

•are present and vote in person at the meeting; or

•have properly submitted a proxy card prior to the meeting.meeting via mail, online voting or telephone voting.

Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the meeting.

What proposals will be voted on at the meeting?

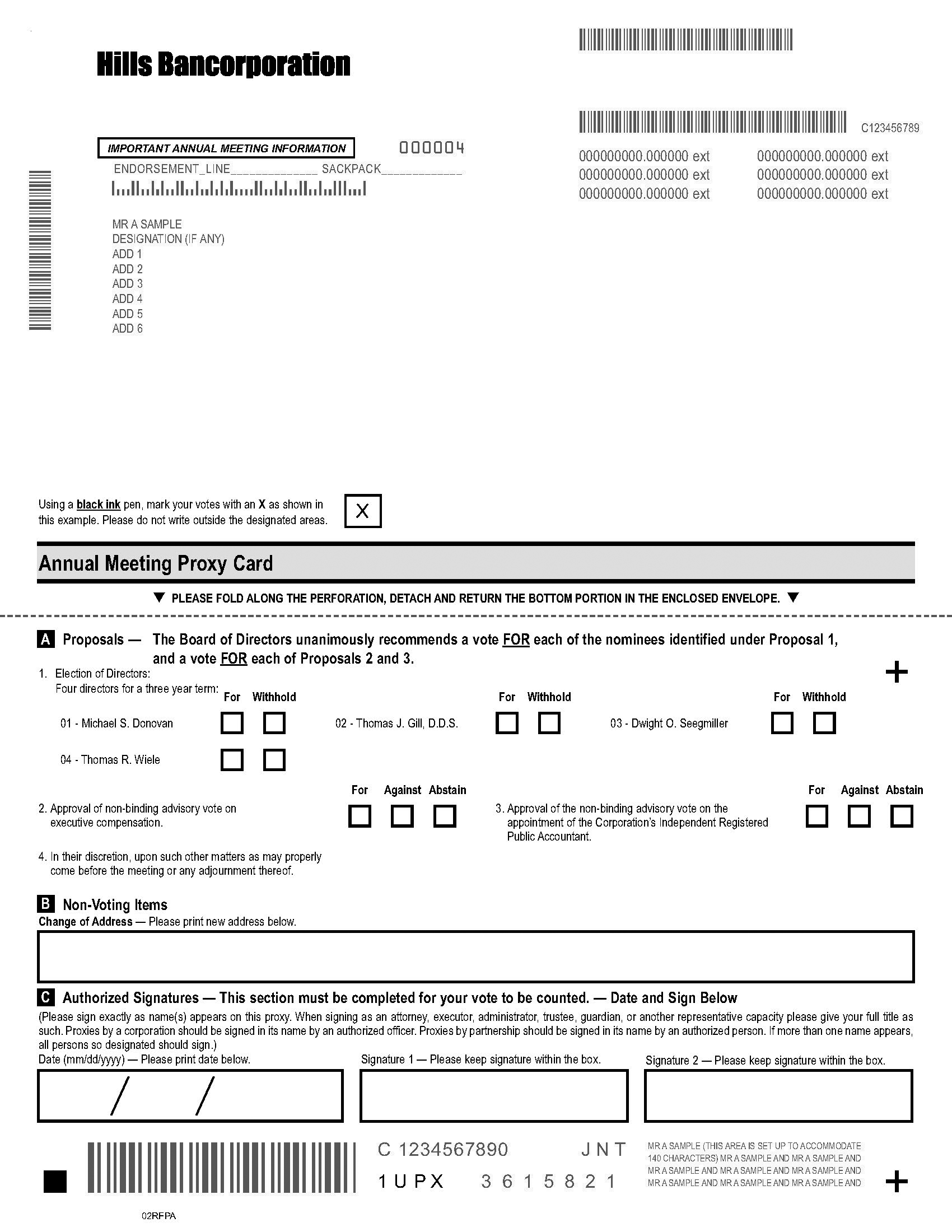

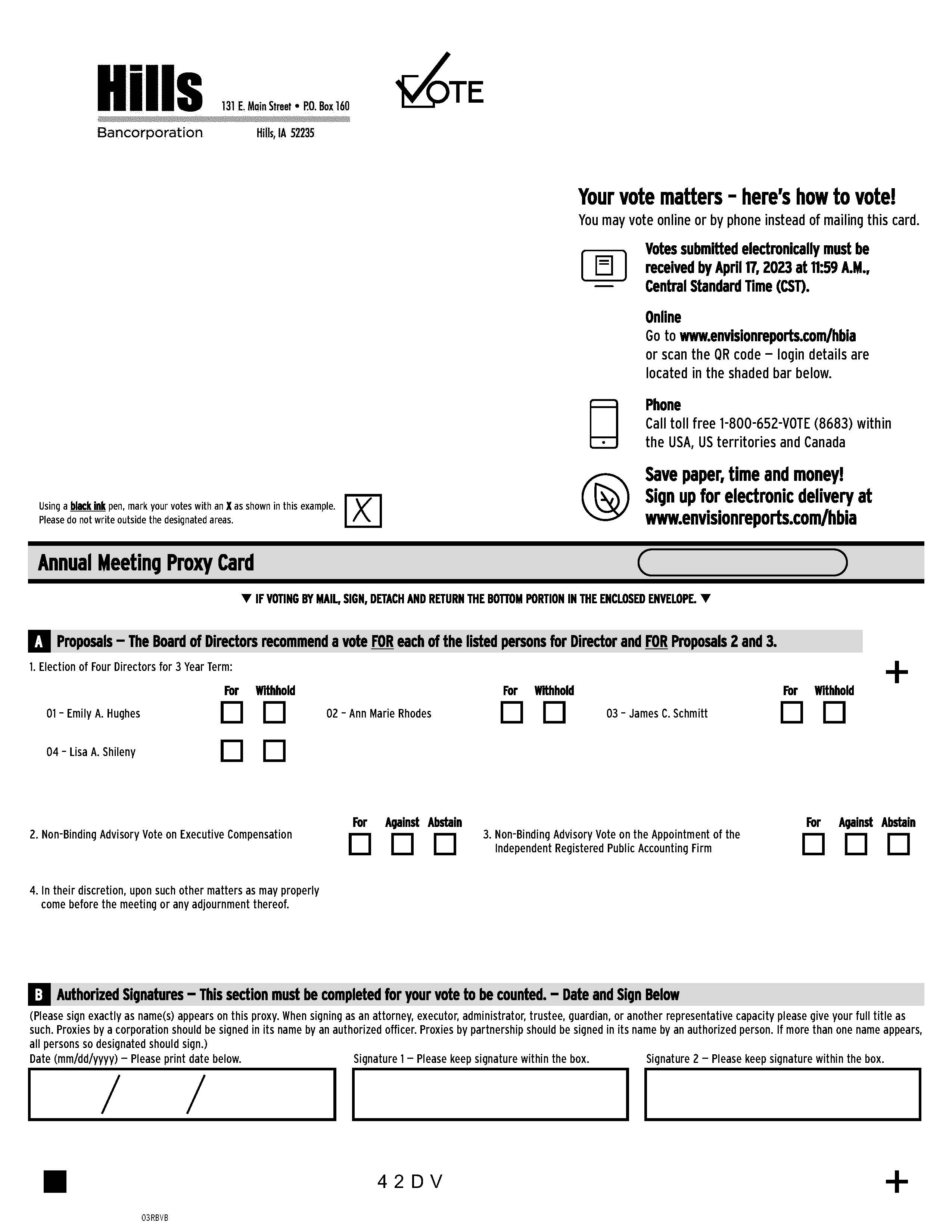

There are three proposals scheduled to be voted on at the meeting which include: (i) the election of members to serve on the CompanyCompany's Board of Directors; (ii) an advisory vote to approve the executive compensation programs of the Company and (iii) an advisory vote on the selection of our independent registered accounting firm, which gives you the opportunity to endorse or not endorse the Company’s appointment of the independent registered public accounting firm.

Who is requesting my vote?

The solicitation of proxies on the enclosed form is made on behalf of the Board of Directors of the Company and will be conducted primarily through the mail. Please mail your completed proxy in the envelope included with these proxy materials. You may also vote by phone or online. Instructions for online and phone voting are on page 5 of this Proxy. In addition to the use of the mail, members of the Board of Directors and certain officers and employees of the Company or its subsidiary may solicit the return of proxies by telephone, facsimile, and other electronic media or through personal contact. The directors, officers and employees thatwho participate in such solicitation will not receive additional compensation for such efforts, but will be reimbursed for out-of-pocket expenses. The cost of preparing, assembling and mailing this Proxy Statement, the Notice of Meeting and the enclosed proxy will be borne by the Company.

3

How many votes are required to approve each proposal?

Proposal One:

Because the election of Directors is determined by a plurality, the nominees receiving the most votes “FOR” will be elected. Shareholders of the Company do not have cumulative voting rights in the election of Directors.

Proposal Two:Two:

Proposal Two, commonly known as a “Say-on-Pay”“Say on Pay” proposal, gives you as a shareholder the opportunity to endorse or not endorse our executive compensation programs. The affirmative vote of a majority of the votes cast by the holders of the Company’s common stock is required to approve Proposal Two, a non-binding advisory vote on executive compensation.

Proposal Three:

The affirmative vote of a majority of the votes cast by the holders of the Company’s common stock is required to approve Proposal Three, a non-binding advisory vote on the appointment of the independent registered public accounting firm.

What are the effects of abstentions and broker non-votes on each proposal?

If you hold your shares in a trust or brokerage account (sometimes referred to as holding shares in “street name”), please note that your bank or brokerage firm has no discretionary voting authority with respect to Proposals One and Two, and therefore cannot vote on any of such proposal in the absence of your instructions. As a result, unless you direct your broker on how to vote your shares with respect to those proposals, your shares will remain un-voted on Proposals One and Two. Shares held in street name for which no voting instructions have been provided by the beneficial owner (and which are not voted by the broker pursuant to discretionary voting authority) are generally referred to as “broker non-votes.” Although abstentions and broker non-votes will be counted for purposes of determining the presence of a quorum, they are not considered votes cast at the meeting.

Proposal One:

Under Proposal One, Directors will be elected by a plurality of the votes cast at the Annual Meeting. This means that the four nominees who receive the largest number of “FOR” votes cast will be elected as directors. Abstentions from voting and broker non-votes, if any, on Proposal One will have no effect on the outcome on the election of Directors.

Proposal Two:

The approval of Proposal Two requires only the vote of the majority of the “votes cast” at the Annual Meeting. Because abstentions from voting and broker non-votes are not treated as “votes cast,” they will have no effect on the outcome of this proposal.

Proposal Three:

Proposal Three requires only the vote of the majority of the “votes cast” at the Annual Meeting. Because abstentions from voting and broker non-votes are not treated as “votes cast”,cast,” they will have no effect on the outcome of this proposal.

How does the Board recommend that I vote?

The Board of Directors urges you to read the Proxy Statement carefully and then vote your shares for the Annual Meeting. The Board of Directors recommends that you vote FOR each of the Director nominees named in this Proxy Statement, and FOR approval of each of Proposals Two and Three.

How are shares voted?

For proposalProposal One, a shareholder may:

•Vote “FOR” each of the nominees for election to the Company’s Board of Directors

•‘WITHHOLD AUTHORITY” to vote for one or more nominees

For Proposals Two and Three, a shareholder may:

•Vote “FOR” the proposal

•Vote “AGAINST” the proposal

•Abstain from voting on the proposal

4

If the accompanying proxy is properly signed and returned, voted by phone, or voted online and is not withdrawn or revoked, the shares represented thereby will be voted in accordance with the specifications thereon. If the manner of voting such shares is not indicated on the proxy, the shares will be voted FOR the election of the nominees for Directors named herein, and FOR the approval of Proposals Two and Three. Your shares will also be voted in the discretion of the proxy committee on any other business properly brought forth at the Annual Meeting

If your shares are held in street name, your bank or broker is not permitted to discretionarily vote on your behalf in the absence of voting instructions from you for any of Proposals One and Two. For your vote to be counted on such proposals, you must communicate your voting decisions to your bank, broker or other holder of record before the date of the Annual Meeting.

How do I vote my shares without attending the meeting?shares?

Whether you hold shares directly or in “street name,”name”, you may direct your vote without attending the Annual Meeting.

If you are a shareholder of record, you may vote by granting a proxy as follows:

•By Mail - You may vote by mail by signing and dating your proxy card and mailing it to the Company in the envelope provided. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, trustee, custodian, attorney or officer of a corporation), you should indicate your name and title or capacity. Proxies submitted by mail must be received by the Treasurer of the Company prior to the vote taken at the Annual Meeting.

•By Phone - You may vote by phone by calling 1-800-652-VOTE (8683) within the USA, US territories and Canada on a touch tone telephone, and following the instructions given. In order to vote your shares by phone, you will need the access code that appears on your proxy card.Votes submitted electronically must be submitted no later than 11:59 a.m. (Central Time) on April 17, 2023.

•By Internet - You may vote by internet by going to the following web site, following the instructions given and entering the requested information on your computer screen.In order to vote your shares by internet, you will need the access code that appears on your proxy card.Votes submitted electronically must be submitted no later than 11:59 a.m. (Central Time) on April 17, 2023.

https://www.envisionreports.com/HBIA

You can also scan the QR code provided on your proxy card to vote with your smartphone. Once you have accessed the secure website, follow the steps as outlined for electronic voting.

Your vote by phone or internet is valid as authorized by Iowa law.

For shares held in “street name,”name”, you should follow the voting instructions provided by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee or, in some cases, submit voting instructions to your broker or nominee by telephone or the internet. If you provide specific voting instructions by mail, telephone, or internet, your broker or nominee will vote your shares as you have directed.

election of directors.

Even if you plan to attend the meeting, we encourage you to submit your proxy by mail so your vote will be counted if you later decide not to attend the meeting.

You can also vote by phone or online.

If you choose to vote at the Annual Meeting:

•If you are a shareholder of record, to vote your shares at the meeting you should bring the enclosed proxy card and proof of identity.

•If you hold your shares in “street name,” you must obtain a proxy in your name from your bank, broker or other holder of record in order to vote at the meeting and bring proof of beneficial ownership (such as a recent brokerage statement or a letter from your bank or broker) and proof of identity.

5

What does it mean if I receive more than one proxy?

It likely means you hold shares registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy. You may also vote each proxy by telephone or online.

May I change my vote?

Yes. A shareholderYou may revoke his or heryour proxy at any time prior to the voting thereof by filing with the Treasurer of the Company at the Company’s principal office at 131 E. Main Street, PO Box 160, Hills, Iowa 52235, a written revocation or a duly executed proxy bearing a later date. You may also revoke your proxy by phone by calling 1-800-652-VOTE (8683) within the USA, US territories and Canada and following the instructions given, or by internet by going to https://www.envisionreports.com/HBIA, following the instructions given and entering the requested information. Any such revocation must be executed prior to 4:00 p.m. (Central Time) on the day of the Annual Meeting. A shareholder may also withdraw the proxy in person at the meeting at any time before it is exercised. The presence of a shareholder at the Annual Meeting, however, will not automatically revoke such shareholder’s previously submitted proxy.

When will the proxy and annual report be mailed to shareholders?

This Proxy Statement and the accompanying Notice of Annual Meeting of Shareholders and proxyAnnual Report to Shareholders are being mailed to the Company's shareholders on or about March 16, 2018.17, 2023.

How may I view the proxy statement and annual report electronically?

The Proxy Statement, and our Annual Report to Shareholders for the fiscal year ended December 31, 2017,2022, are available online and may be accessed at www.envisionreports.com/HBIA or www.edocumentview.com/HBIA.

PROPOSAL ONE

ELECTION OF DIRECTORS

INFORMATION CONCERNING NOMINEES FOR ELECTION AS DIRECTORS

The Company currently has eleven Directors with staggered terms of office. Ms. Lisa A. Shileny, the President and Chief Operating Officer of the Bank, has been nominated to serve a three-year term as a new member of the Board of Directors which would increase the number of Directors to twelve. Each of the other nominees for election presently serves on the Board of Directors and is being nominated to serve a three-year term. The Board of Directors has no reason to believe that any nominee will be unable to serve as a Director, if elected. However, in casethe event any nominee should become unavailable for election, the proxy will be voted for such substitute, if any, as the Board of Directors may designate.

Each Director of the Company also serves as a Director of the Company’s wholly-owned subsidiary, Hills Bank and Trust Company (the “Bank”), which is a commercial bank. The Company anticipates that, following the election of the nominees set forth below, all Directors of the Company will serve, or continue to serve, as Directors of the Bank. The Directors of the Bank are elected by the vote of the Company as the sole shareholder of the Bank.

6

Set forth below are the names of the four persons nominated by the Board of Directors for election as Directors of the Company at the 20182023 Annual Meeting, along with certain other information concerning such persons.

| Name and Year First Become Director | Age | Positions & Offices Held With Company | Principal Occupation or Employment During the Past Five Years and Education Pertaining to Board of Director Qualifications | |||||||||||||||||||||||

| Director Serving Until the | ||||||||||||||||||||||||||

2012 - Company 2012 - Bank | 55 | Director | Michigan Law School. | |||||||||||||||||||||||

1993 - Company 1993 - Bank | Director | |||||||||||||||||||||||||

| James C. Schmitt 2019 - Company 2019 - Bank | 67 | Director | Senior Principal Consultant, Expense Reduction Analysts, and Managing Director, James C. Schmitt Consulting, L.L.C., both Cedar Rapids, Iowa businesses. Mr. Schmitt is a graduate of the University of Northern Iowa Iowa. | |||||||||||||||||||||||

2023 - Company 2023 - Bank | Nominee for Director | President and | ||||||||||||||||||||||||

Administration. | ||||||||||||||||||||||||||

Additional information regarding the Directorsfour nominees for election to serve until the 2021 Annual MeetingBoard of Directors is as follows:

7

Iowa, provides important insight to the Board of Directors. Ms. Rhodes is a member of the National AssociationAmerican and Iowa Bar Associations. In addition, Ms. Rhodes is involved in leadership roles in several community organizations.

James C. Schmitt: Mr. Schmitt was elected to the Board of Automobile Dealers,Directors in 2019. Mr. Schmitt serves as the Chairperson of the Audit Committee and is considered its financial expert. Mr. Schmitt also serves as a member of the Compensation and Incentive Stock Committee of the Board of Directors. Mr. Schmitt graduated from the University of Northern Iowa Associationwith a Degree in Accounting and is a CPA. Mr. Schmitt also obtained an MBA from the University of Automobile DealersIowa. Mr. Schmitt spent 13 years with RSM US, LLP in Cedar Rapids, Iowa and Charlotte, North Carolina, serving as the Chevrolet SocietyPartner in Charge of Sales Executives.the Charlotte office during his tenure. Mr. Wiele’s business expertiseSchmitt spent 13 years as the president of an electrical distributor in Cedar Rapids, Iowa. Mr. Schmitt has served on the Board of Directors of commercial businesses and not-for-profit organizations in the Cedar Rapids, Iowa area. Mr. Schmitt's financial knowledge areis a valuable contribution to the Board of DirectorsDirectors. Mr. Schmitt is an active member of the Cedar Rapids community. Hills Bank currently has three banking offices in Cedar Rapids and provides important insight intotwo in neighboring Marion; Mr. Schmitt's knowledge and contacts in this area will be invaluable in assisting with the expansion in this market.

Lisa A. Shileny: Ms. Shileny is a nominee to be elected to the Board of Director’s loan responsibilities. Mr. Wiele has considerableDirectors. Ms. Shileny is the President and Chief Operating Officer of the Bank. Prior to becoming President and Chief Operating Officer of the Bank, Ms. Shileny served as the Company’s General Counsel, Director of Operations, and Director of Administration. Ms. Shileny joined the Bank in 2005. Ms. Shileny is a graduate of Central College, the University of Iowa College of Law, and the Graduate School of Banking at the University of Wisconsin – Madison, and she will graduate in 2023 from the Stonier Graduate School of Banking at the Wharton School of Business of the University of Pennsylvania. In addition, Ms. Shileny is a member of the Iowa bar association. Ms. Shileny's knowledge of the Company’s trade areaCompany and is activethe Bank in community organizations.her various roles will provide valuable contributions to the Board of Directors.

None of the nominees currently serves, or has served in the past five years, as a Director of another company whose securities are registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or whose securities are subject to the requirements of Section 15(d) of the Exchange Act or a company registered under the Investment Company Act of 1940, as amended. There are no family relationships among the Company’s Directors, nominees for Director and executive officers.

The Board of Directors unanimously recommends to the Shareholders a vote “FOR” the election of the above-listed persons as Directors for the Company. | ||||||||||||||

PROPOSAL TWO

NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), Section 14A of the Securities Exchange Act (15 USC 78n-1) and related SEC regulations, the Company is providing shareholders with an advisory (non-binding) vote on compensation programs for our Named Executive Officers (commonly referred to as “Say on Pay”). As approved by its shareholders at the 2017 annual meeting, the Company is submitting this non-binding vote to shareholders on an annual basis. The following resolution is presented for consideration at the Annual Meeting.

“RESOLVED, that the compensation paid to the Company’s Named Executive Officers, as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K of the SEC, including the Compensation Discussion and Analysis, compensation tables, and the related narrative disclosure is hereby APPROVED.”

This vote is non-binding. The Board and the Compensation and Incentive Stock Committee, which is comprised of non-employee Directors, expect to take into account the outcome of the vote when considering future executive compensation decisions to the extent they can determine the cause or causes of any significant negative voting results.

Shareholders are encouraged to review the Compensation Discussion and Analysis section of this Proxy Statement for a detailed discussion of our executive compensation programs. The affirmative vote of a majority of the shares of common stock cast at the meeting, in person or by proxy, and entitled to vote thereon is required to approve Proposal Two.

8

The Board of Directors unanimously recommends that you vote “FOR” the approval, on an advisory basis, of the compensation of our Named Executive Officers as disclosed in the Compensation Discussion and Analysis, the accompanying compensation tables, and the related narrative disclosure. | ||||||||||||||

PROPOSAL THREE

NON-BINDING ADVISORY VOTE ON THE APPOINTMENT OF THE INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors proposes and recommends that the shareholders approve the selection by the Committee of the firm of FORVIS, LLP (formerly BKD LLPLLP) to serve as the Company’s independent registered public accounting firm for the 20182023 fiscal year. FORVIS, LLP was formed as the merger of BKD LLP and Dixon Hughes Goodman LLP (DHG) effective June 1, 2022. The firm has served as independent auditors for the Company since 2012. Action by the shareholders is not required by law in the appointment of an independent registered public accounting firm, but theirthe firm's appointment is submitted by the Audit Committee of the Board of Directors in order to give the shareholders a voice in the designation of auditors. If the resolution approving BKDFORVIS, LLP as the Company’s independent registered public accounting firm is rejected by the shareholders, the Committee will reconsider its choice of independent auditors. Even if the resolution is approved, the Audit Committee, in its discretion, may direct the appointment of different independent auditors at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

Proxies in the form solicited hereby which are returned to the Company will be voted in favor of this non-binding proposal unless otherwise instructed by the shareholder. The affirmative vote of a majority of the shares of common stock cast at the meeting, in person or by proxy, and entitled to vote thereon is required to approve Proposal Three.

The Board of Directors unanimously recommends to the Shareholders a vote “FOR” the non-binding advisory proposal to approve the appointment of the Company’s Independent Registered Public Accounting Firm. | ||||||||||||||

INFORMATION CONCERNING DIRECTORS OTHER THAN NOMINEES

The following tables set forth certain information with respect to Directors of the Company who will continue to serve as Directors subsequent to the 20182023 Annual Meeting and who are not nominees for election at the 20182023 Annual Meeting.

9

Additional information regarding the Directors to serve until the 20192024 Annual Meeting is as follows:

| Name and Year First Become Director | Age | Positions & Offices Held With Company | Principal Occupation or Employment During the Past Five Years and Education Pertaining to Board of Director Qualifications | |||||||||||||||||

| Director Serving Until the 2024 Annual Meeting | ||||||||||||||||||||

| Michael S. Donovan 2007 - Company 2007 - Bank | 60 | Director | Farmer and President of Donovan & Sons, Ltd., a local Johnson County, Iowa family farm corporation, and partner in PVP1, LLP, a local pork production operation. Mr. Donovan is a graduate of North Iowa Area Community College. | |||||||||||||||||

| Kirsten H. Frey 2019 - Company 2019 - Bank | 54 | Director | Attorney and Senior Vice President, Shuttleworth & Ingersoll, P.L.C., a law firm located in Iowa City, IA. Ms. Frey is an attorney and obtained her law degree and an MBA from the University of Iowa. | |||||||||||||||||

| Dwight O. Seegmiller 1986 - Company 1986 - Bank | 70 | Director and President | President of the Company. Mr. Seegmiller is a graduate of Iowa State University’s Agricultural Business Honors Program and the Stonier Graduate School of Banking at Rutgers University. He joined the Company in 1975 and has been President of the Company since 1986. Prior to 1986, Mr. Seegmiller was the Senior Vice President of Lending. | |||||||||||||||||

| Thomas R. Wiele 2012 - Company 2012 - Bank | 70 | Director | President, Dealer and Operator of Wiele Motor Company, located in West Liberty and Columbus Junction, Iowa. | |||||||||||||||||

Michael S. Donovan: Mr. Donovan was elected to the Board of Directors in 2007. Mr. Donovan serves on the Trust Committee, Loan Committee, and the Compensation and Incentive Stock Committee of the Board of Directors. Mr. Donovan is a farmer and the President and a shareholder of Donovan and Sons, Ltd, an Iowa farm corporation. Mr. Donovan also is a partner in PVP1, LLP, a pork production operation in the Company’s trade area. Mr. Donovan is a graduate of North Iowa Area Community College. Mr. Donovan’s expertise and agricultural knowledge, especially in the area of hog production, is a valuable contribution to the Board of Directors and provides important insight into the Board of Directors’ loan responsibilities.

Kirsten H. Frey: Ms. Frey was elected to the Board of Directors in 2019. Ms. Frey serves on the Trust Committee and the Compensation and Incentive Stock Committee of the Board of Directors. Ms. Frey is an attorney and senior vice president at the law firm Shuttleworth & Ingersoll, P.L.C. located in Coralville, Iowa. Ms. Frey graduated with distinction from the University of Iowa College of Law and obtained a Masters of Business Administration from the University of Iowa Henry B. Tippie School of Management. Ms. Frey has served as an adjunct assistant professor at the University of Iowa Henry B. Tippie College of Business, teaching undergraduate and graduate courses. Ms. Frey is a member of the Johnson County and Iowa State Bar Associations. Ms. Frey is an active member of the Iowa City community, serving on boards of directors of several Iowa City area not-for-profit organizations. Ms. Frey's knowledge of the community and her legal expertise provide valuable insight to the Board of Directors.

Dwight O. Seegmiller: Mr. Seegmiller has served as a Director of the Company since 1986. Mr. Seegmiller is the President and Chief Executive Officer of the Company and the Chief Executive Officer of the Bank. Prior to becoming President of the Company and the Bank in 1986, Mr. Seegmiller was the Senior Vice President of Lending. Mr. Seegmiller joined the Bank in 1975. Mr. Seegmiller graduated from Iowa State University’s Agricultural Business Honors Program. Mr. Seegmiller graduated from the Stonier Graduate School of Banking at Rutgers University in 1981. Mr. Seegmiller’s knowledge of the Company and the Bank provide consistent and valuable contributions to the Board of Directors.

Thomas R. Wiele: Mr. Wiele was elected to the Board of Directors in 2012. Mr. Wiele serves on the Audit Committee and the Compensation and Incentive Stock Committee of the Board of Directors. Mr. Wiele is the President, a dealer and operator of Wiele Motor Company located in West Liberty and Columbus Junction, Iowa. Wiele Motor Company is a local

10

Chevrolet automobile dealer. Mr. Wiele has been a partner of Wiele Motor Company since 1978 and President since 1996. Mr. Wiele is a member of the National Association of Automobile Dealers, the Iowa Association of Automobile Dealers and the Chevrolet Society of Sales Executives. Mr. Wiele’s business expertise and knowledge are a valuable contribution to the Board of Directors and provide important insight into the Board of Directors' loan responsibilities. Mr. Wiele has considerable knowledge of the Company’s trade area and is active in community organizations.

Additional information regarding the Directors to serve until the 2025 Annual Meeting is as follows:

| Name and Year First Become Director | Age | Positions & Offices Held With Company | Principal Occupation or Employment During the Past Five Years and Education Pertaining to Board of Director Qualifications | |||||||||||||||||

| Director Nominees Who Will Serve Until the | ||||||||||||||||||||

Michael E. Hodge 2000 - Company 2000 - Bank | Director | President and shareholder of Hodge Construction Company, an Iowa City, Iowa business. Mr. Hodge obtained a BS in civil engineering from the University of Iowa. | ||||||||||||||||||

Casey L. Peck 2019 - Company 2019 - Bank | 48 | Director | General Manager and Chief Financial Officer, Kalona Cooperative Technology Company located in Kalona, Iowa. Ms. Peck is a graduate of Coe College with a BA in accounting and business administration. | |||||||||||||||||

| John W. Phelan 2007 - Company 2007 - Bank | Director | Owner of Phelan Distributing LLC, a wholesale wine distributor in Cedar Rapids, Iowa. | ||||||||||||||||||

Sheldon E. Yoder, D.V.M. 1997 - Company 1997 - | Director | President and shareholder of Kalona Veterinary Clinic, P.C., located in Kalona, Iowa. Dr. Yoder is a graduate of the Iowa State University College of Veterinary Medicine. He has been President of Kalona Veterinary Clinic since 1978. | ||||||||||||||||||

Michael E. Hodge: Mr. Hodge has served as a Directorwas elected to the Board of the Company and the Bank sinceDirectors in 2000. Mr. Hodge presently serves on the Risk Committee, Loan Committee, and the Compensation and Incentive Stock Committee of the Board of Directors. Mr. Hodge is a graduate of the University of Iowa College of Engineering with a BS in civil engineering. He is the President and principal shareholder of Hodge Construction Company founded in Iowa City, Iowa in 1981. Hodge Construction Company is a private company that is involved in real estate development and as a builder primarily in Iowa City, Coralville, North Liberty and the Cedar Rapids area.areas. The Bank has office locations in each of these communities. Mr. Hodge is active in several professional trade associations in the Iowa City area. Mr. Hodge has significant experience in real estate development, including single family, and multi-family and commercial projects and provides important insight to the Board of Directors for the Loan Committee.Directors' loan responsibilities. In addition, Mr. Hodge is actively involved in leadership roles in several non-profit organizations in the Iowa City market.

Casey L. Peck: Ms. Peck was elected to the Board of Directors in 2019. Ms. Peck serves on the Risk Committee, Loan Committee, and the Compensation and Incentive Stock Committee of the Board of Directors. Ms. Peck is the general manager and chief financial officer of Kalona Cooperative Technology Company, located in Kalona, Iowa. Ms. Peck graduated from Coe College obtaining a BA in accounting and business administration. Ms. Peck is the Treasurer of the Kalona Chamber of Commerce and is actively involved in many non-profit organizations in the Kalona community. The Bank has three branch offices in Washington County, Iowa. Ms. Peck's knowledge of the economic and small business environment in Kalona and Washington County provides valuable insight into the Company's southern region and provides important insight into the Board of Directors' loan responsibilities.

John W. Phelan: Mr. Phelan was elected to the Board of Directors in 2007. Mr. Phelan at that time also became a member of the Board of Directors of the Bank. The Board Committees which Mr. Phelan serves on are the Trust Committee and the Compensation and Incentive Stock Committee.Committee of the Board of Directors. Mr. Phelan is the owner of Phelan Distributing LLC, a wholesale wine distributor in Cedar Rapids, Iowa. Mr. Phelan is originally from Iowa City, Iowa and is currently an active member of the Cedar Rapids community. The Bank currently has three branch offices in Cedar Rapids and two in neighboring Marion so Mr. Phelan’s knowledge and contacts in this marketarea have been invaluable in assisting with the expansion of this market. Mr. Phelan is a past president of the State of Iowa Broadcasters Association and a long-term Board member

11

of that organization. Mr. Phelan is active as a Board member in two non-profit organizations with connections to the University of Iowa in Iowa City, Iowa as well as involvement in non-profit organizations in Cedar Rapids, Iowa.

Sheldon E. Yoder, D.V.M.: Dr. Yoder was first elected to serve as a Directorthe Board of Directors in 1997 and has also served as a Director of the Bank since 1997. Dr. Yoder presently serves on the Audit Committee and the Compensation and Incentive Stock Committee of the Board of Directors. Dr. Yoder is a graduate of Iowa State University College of Veterinary Medicine. He is the President and the sole shareholder of Kalona Veterinary Clinic, P.C., which he founded in 1978 in Kalona, Iowa. Dr. Yoder is a life-long resident of the Kalona area and, as a community leader and business person, has considerable knowledge that continues to be especially favorable to the Bank’s Kalona and Wellman offices. Dr. Yoder’s small business expertise and agriculture knowledge also continuescontinue to be a valuable contribution to the Board of Directors. Dr. Yoder is active professionally with the American

Veterinary and Iowa Veterinary Associations. Dr. Yoder has demonstrated active involvement in the community’s non-profit organizations in the Kalona community.

None of the Directors currently serves, or has served in the past five years, as a Director of another company whose securities are registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or whose securities are subject to the requirements of Section 15(d) of the Exchange Act or a company registered under the Investment Company Act of 1940, as amended. There are no family relationships among the Company’s Directors, nominees for Director and executive officers.

CORPORATE GOVERNANCE AND THE BOARDS OF DIRECTORS

Board of Directors of the Company

The Board of Directors of the Company meets on a regularly scheduled basis. During 2017,2022, the Board of Directors of the Company held an annual meeting, one special meeting and twelve regular meetings. During 2017,2022, all Directors of the Company attended at least seventy-five percent of the total number of meetings of the Board and all of the committees to which such Directors were appointed. Although the Company does not have a formal policy regarding attendance by Directors at annual shareholder meetings, such attendance is encouraged. In 2017,2022, all eleven of the Company’s Directors attended the annual shareholders’ meeting.

The Board of Directors of the Company has established a committee (the "Governance and Nominating Committee") consisting of the ten non-employee Directors (i.e., all(all Directors but Mr. Seegmiller), all of whom are considered to be independent as defined under the rules of NASDAQ, except for Mr. Hodge. The Governance and Nominating Committee assists in identifying individuals qualified to become Board members, and to recommendrecommends nominees for director (including evaluating candidates recommended by shareholders), recommends the corporate governance guidelines applicable to the Company, oversees an annual review of the Board's performance, recommends director nominees for each committee, recommends a determination of each outside director's "independence" under applicable rules and guidelines, oversees the Company's engagement with stockholders and other interested parties concerning governance and other related matters, and oversees reputation risk related to Committee's responsibilities. The Governance and Nominating Committee met on April 17, 2017.18, 2022. Directors are not compensated for meetings of the Governance and Nominating Committee. The Board of Directors has adopted a written charter for the Governance and Nominating Committee, a copy of which is available on the Company's website at www.hillsbank.com under the heading of investor relations."Investor Relations."

The Board of Directors of the Company has established a committee (the “Audit Committee”) consisting of three non-employee Directors, currently consisting of Directors Hughes, NowakWiele, Yoder and Yoder.Schmitt. The Board of Directors has adopted a written charter for the Audit Committee. A copy of the charter is available on the Company’s website at www.hillsbank.com under the heading of investor relations."Investor Relations." The Audit Committee is responsible for the engagement of the independent registered public accounting firm and reviews with the independent registered public accounting firm the scope and results of the audits, the Company’s internal accounting controls and the professional services furnished by the independent registered public accounting firm. All three members of the Audit Committee are “independent” as defined under the rules of NASDAQ. Due to his experience as noted above, the Board has determined that Director NowakSchmitt qualifies as an Audit Committee Financial Expert under applicable regulations. In addition, because the Bank had total assets in excess of $3 billion as of the beginning of fiscal year 2023, our audit committee is also required to have an additional member having "banking or related financial management expertise." The Board has determined that Director Peck qualifies in this respect. The Audit Committee met six times in 2017.2022. Audit Committee members are compensated by the Bank as indicated below under the heading “Schedule of Directors Fees.”

12

The Board of Directors of the Company has established a committee (the “Compensation and Incentive Stock Committee”) consisting of the ten non-employee Directors (i.e., all(all Directors but Mr. Seegmiller), all of whom are considered to be independent as defined under the rules of NASDAQ, except for Mr. Hodge. The Compensation and Incentive Stock Committee makes

decisions regarding executive officer salaries, bonuses, grants of awards to all officers pursuant to the Hills Bancorporation 20102020 Stock Option and Incentive Plan (the “Incentive Stock Plan”), contributions to the Hills Bank and Trust Company Employee Stock Ownership Plan (the “ESOP”), and contributions to the Hills Bank and Trust Company 401(k) Profit Sharing Plan (the “Profit Sharing Plan”). The Compensation and Incentive Stock Committee held tennine meetings during 2017.2022. The tennine meetings involved approval of grants of restricted stock to officers. Directors are not compensated for meetings of the Compensation and Incentive Stock Committee. The Board of Directors has adopted a written charter for the Compensation and Incentive Stock Committee, a copy of which is available on the Company's website at www.hillsbank.com under the heading of investor relations."Investor Relations."

The Board of Directors of the Company has established a committee (the "Risk Committee") consisting of three non-employee Directors, currently consisting of Directors Donovan, NowakPeck, Hodge and Rhodes.Hughes. The Board of Directors has adopted a written charter for the Risk Committee. A copy of the charter is available on the Company's website at www.hillsbank.com under the heading of investor relations."Investor Relations." The Risk Committee oversees and approves the Company-wide risk management practices to assist the board in overseeing the management team's identification and assessment of risks facing the organization and establishment of a risk management infrastructure capable of addressing those risks, the division on risk-related responsibilities to each Board committee as clearly as possible to determine that the oversight of risks is not missed, and approvingapproval of the Company's enterprise risk management framework. The Risk Committee held six meetings during 2017.2022. Risk Committee members are compensated by the Bank as indicated below under the heading "Schedule of Directors Fees."

Each of the Company’s Directors, with the exception of Mr. Seegmiller and Mr. Hodge, has been determined by the Board of Directors to be an “Independent Director” as defined by Rule 5605(a)(2) of the Marketplace Rules of the National Association of Securities Dealers Automated Quotation system (“NASDAQ”). Mr. Seegmiller is not considered to be independent since he is the President and CEO of the Company and the Bank. Mr. Hodge is not independent underCEO of the NASDAQ definition based on certain transactions between the Company and Mr. Hodge’s affiliated companies during the prior three fiscal years, including the transactions described in the section of this Proxy Statement captioned “Compensation and Incentive Stock Committee Interlocks and Certain Other Transactions with Executive Officers and Directors.”Bank. In determining Director independence, the Board of Directors considers all relevant facts and circumstances, including the independence standards set forth in the rules of NASDAQ. In order to be considered independent, a Director must be free from any relationship which, in the opinion of the Company’s Board of Directors would interfere with the exercise of independent judgment. The Board of Directors considered certain transactions, relationships or arrangements which are described herein under the heading “Compensation and Incentive Stock Committee Interlocks and Certain Other Transactions with Executive Officers and Directors”Insider Participation” in making its determination of director independence.

Board of Directors of the Bank

The business and affairs of the Bank are managed by the Board of Directors of the Bank, the membership of which is identical to that of the Board of Directors of the Company. The Board of Directors of the Bank holds regular monthly meetings. In 2017,2022, the Board of Directors of the Bank held an annual meeting, one special meeting and twelve regular meetings. The Board of Directors of the Bank has established the Trust Committee, the Audit Committee, the Risk Committee, the Loan Committee and the Employee Stock Ownership Plan (“ESOP”) Committee as standing committees of the Board of Directors of the Bank. Directors Gill,Frey, Phelan, Rhodes, Seegmiller and WieleDonovan serve on the Trust Committee; Directors Hughes, NowakWiele, Yoder and YoderSchmitt serve on the Audit Committee; Directors Donovan, NowakPeck, Hughes and RhodesHodge serve on the Risk Committee; Directors Gill,Donovan, Hodge, Hughes, WielePeck and Seegmiller serve on the Loan Committee; and Director PachaRhodes serves on the ESOP Committee. The sixseven Directors not appointed to the Loan Committee are invited to attend meetings of that committee and are compensated for such attendance at the same rate as members of the Loan Committee for each meeting attended. The Board of Directors of the Bank has established the Governance and Nominating Committee that meets as needed as part of regularly scheduled Board meetings.

The Trust Committee of the Bank is responsible for overseeing and annually reviewing the operations of the Trust Department of the Bank and the status of all trusts for which the Bank’s Trust Department acts in a fiduciary capacity. The Trust Committee met twelve times during 2017.2022. The Audit Committee held six meetings during 20172022 and is responsible for coordinating the audit with BKDFORVIS, LLP and addressing internal audit functions. The Risk Committee held six meetings during 20172022 and is responsible for oversight of the Bank's enterprise risk management program. The Loan Committee held twelve meetings during 20172022 and is responsible for review and oversight of the loan activities of the Bank. The ESOP Committee, which is responsible for overseeing the ESOP in connection with which the Bank’s Trust Department serves as trustee, had three meetings during 2017.2022. During 2017,2022, all of the Directors of the Bank attended at least 75%seventy-five percent of the total number of meetings of the Board of Directors and all of the Directors of the Bank appointed to committees attended at least 75%seventy-five percent of the meetings of the committee to which such Directors were appointed.

13

Board Leadership Structure and Role in Risk Oversight

The leadership structure of the Board of Directors leadership structure has historically separated the function of the Chairperson of the Board of the Bank and the Principal Executive Officer. This structure is expected to continue in the future with the Chairperson of the Bank’s Board of Directors being a non-employee Director. This structure promotes good corporate governance by providing a non-management leadership structure and such a leadership structure is encouraged by bank regulators. The Company’s Board of Directors has not designated a Chairperson, and Mr. Seegmiller currently acts as the de facto chair at all meetings thereof, which generally followprecedes meetings of the Bank’s Board of Directors. The Company currently has no designated “lead independent director” with respect to its Board and believes this structure is appropriate because all significant business operations continue to be conducted at the Bank level.

The Company is exposed to risks as part of the normal course of business. Risk exposure requires sound risk management practices that comprise ana comprehensive framework of programs and processes that apply to the Company. The Company has established a risk management framework to manage risks and provide reasonable assurance of the achievement of the Company's strategic objectives. The primary risks identified and managed through the framework are strategic risk, liquidity risk, market risk, credit risk, trust risk, information technology and security risk, operational risk, legal risk and reputational risk.

The principal risk management functions of the Board are to oversee processes for evaluating the adequacy of internal controls, risk management, financial reporting and compliance with laws and regulations. The Board, through its Risk Committee, has developed a formal plan to address Enterprise Risk Management ("ERM") within the Company. The Company's ERM includes a formal process to identify and document the key risk to the Company and provides a common framework and terminology to ensure consistency in identification, reporting and management of key risks. The Board annually approves, upon the recommendation of its Risk Committee, a Risk Appetite and Tolerance Statement that reflects core business principles and provides the foundation of the Company's risk appetite, which is the aggregate amount of risk the Company is willing to accept in pursuit of its mission. By establishing boundaries around risk taking and business decisions, and by incorporating the needs and goals of its shareholders, regulators, customers and other stakeholders, the Company's risk appetite is aligned with its priorities and goals.

The Board has formed an Enterprise Risk Management Committee ("ERMC") of the Company comprised of the Company's business unit leaders and led by the Company's Senior Vice President, Director of Risk Management,General Counsel, to help ensure the consistent application of the Company's risk management approach. The primary activities of the ERMC include:

•Annual comprehensive risk assessments for all of the risks identified in the Company's risk management framework;

•Monitoring signals that may indicate possible risk issues for the Company;

•Identifying risks and determining which Company areas and/or products will be affected;

•Ensuring there are mechanisms in place to specifically determine how risks will affect the Company or its products;

•Monitoring and reporting on risk tolerance thresholds approved by the Board; and

•Reviewing the limits, policies, and procedures in place to ensure the continued appropriateness of risk controls.

The Company has also formed an Officers Risk Management Committee ("ORMC") which consists of the next level of management from within the Company. The primary activities of the ORMC include:

•New product and/or service risk assessments;

•Discussion and identification of potential risk issues to report to the ERMC; and

•Tactical working groups to identify additional risk management activities to be pursued by the Company.

As part of the risk assessment process, the ERMC and ORMC each report the results of their evaluations to the Risk Committee of the Board of Directors and make recommendations to the Risk Committee regarding adjustments to controls as conditions or risk tolerances change.

Schedule of Directors Fees

Directors of the Company and the Bank who are not employees of the Company or the Bank (all Directors but Mr. Seegmiller) are compensated for their service as a Directors as indicated in the table below:

14

| Compensation Item | Company | Bank | Compensation Item | Company | Bank | |||||||||||||||

| Annual Retainer (paid quarterly): | Annual Retainer (paid quarterly): | |||||||||||||||||||

| Chairperson of the Board | N/A | $ | 19,450 | Chairperson of the Board | N/A | $ | 23,300 | |||||||||||||

| Board Member | N/A | 14,700 | Board Member | N/A | 17,600 | |||||||||||||||

| Meeting Fees: | Meeting Fees: | |||||||||||||||||||

| Board Meetings | $360 | 570 | Board Meetings | $435 | 680 | |||||||||||||||

| Committee: | Committee: | |||||||||||||||||||

| Audit | N/A | 360 | Audit | N/A | 435 | |||||||||||||||

| Risk | N/A | 360 | Risk | N/A | 435 | |||||||||||||||

| Governance | N/A | N/A | Governance | N/A | N/A | |||||||||||||||

| Compensation and Incentive Stock | N/A | N/A | Compensation and Incentive Stock | N/A | N/A | |||||||||||||||

| Employee Stock Ownership Plan / Profit Sharing | N/A | 360 | Employee Stock Ownership Plan / Profit Sharing | N/A | 435 | |||||||||||||||

| Loan | N/A | 360 | Loan | N/A | 435 | |||||||||||||||

| Trust | N/A | 360 | Trust | N/A | 435 | |||||||||||||||

Director Deferral Plan:

Under the Company’s Nonqualified Deferred Compensation Plan (the “Deferred Compensation Plan”), which was initiated in 1997, each Director may elect to defer up to 50% of such Director’s cash compensation from retainers and meeting fees. Any amount so deferred is credited to the Director’s deferred compensation account and converted into units equivalent in value to the fair market value of a share of stock in Hills Bancorporation at the time of such conversion. The “stock units” are book entry only and do not represent an actual issuance of stock. The Director’s account is adjusted each year for dividends paid and the change in the market value of Hills Bancorporation stock. The liability for the deferred Directors’ fees is unfunded and unsecured for the participants. The amounts are payable in cash in five annual installments upon the earliest of the following: change of control of the Company, termination of the Director from the Board of Directors of the Company and the Bank, or when the Director reaches the age of seventy-two years.

Director Compensation Table

The following table provides information concerning the compensation of all the Directors other than Mr. Seegmiller for the fiscal year ended December 31, 2017.2022. Compensation information for Mr. Seegmiller is discussed below in the section captioned “Summary of Cash and Certain Other Compensation Paid to the Named Executive Officers.”

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||||||||||||||

| Michael S. Donovan | $ | 41,020 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 41,020 | ||||||||||||||||||||||||||||||

| Kirsten H. Frey | 41,455 | — | — | — | — | — | 41,455 | |||||||||||||||||||||||||||||||||||||

| Michael E. Hodge | 38,860 | — | — | — | — | — | 38,860 | |||||||||||||||||||||||||||||||||||||

| Emily A. Hughes | 38,425 | — | — | — | — | — | 38,425 | |||||||||||||||||||||||||||||||||||||

| Casey L. Peck | 38,860 | — | — | — | — | — | 38,860 | |||||||||||||||||||||||||||||||||||||

| John W. Phelan | 41,020 | — | — | — | — | — | 41,020 | |||||||||||||||||||||||||||||||||||||

| Ann Marie Rhodes | 46,700 | — | — | — | — | — | 46,700 | |||||||||||||||||||||||||||||||||||||

| James C. Schmitt | 38,440 | — | — | — | — | — | 38,440 | |||||||||||||||||||||||||||||||||||||

| Thomas R. Wiele | 38,860 | — | — | — | — | — | 38,860 | |||||||||||||||||||||||||||||||||||||

| Sheldon E. Yoder, D.V.M. | 38,425 | — | — | — | — | — | 38,425 | |||||||||||||||||||||||||||||||||||||

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

| Michael S. Donovan | $ | 31,905 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 31,905 | ||||||||||||||

| Thomas J. Gill, D.D.S. | 35,685 | — | — | — | — | — | 35,685 | |||||||||||||||||||||

| Michael E. Hodge | 30,485 | — | — | — | — | — | 30,485 | |||||||||||||||||||||

| Emily A. Hughes | 33,565 | — | — | — | — | — | 33,565 | |||||||||||||||||||||

| James A. Nowak | 34,455 | — | — | — | — | — | 34,455 | |||||||||||||||||||||

| Theodore H. Pacha | 36,488 | — | — | — | — | — | 36,488 | |||||||||||||||||||||

| John W. Phelan | 33,125 | — | — | — | — | — | 33,125 | |||||||||||||||||||||

| Ann Marie Rhodes | 32,265 | — | — | — | — | — | 32,265 | |||||||||||||||||||||

| Thomas R. Wiele | 34,655 | — | — | — | — | — | 34,655 | |||||||||||||||||||||

| Sheldon E. Yoder, D.V.M. | 32,315 | — | — | — | — | — | 32,315 | |||||||||||||||||||||

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

Set forth in the following table is certain information on each person who is known to the Board of Directors to be the beneficial owner as of March 2, 20183, 2023 of more than 5% of the Company’s Common Stock, which is the only class of equity securities that the Company has outstanding.

Amount and Nature of Beneficial Ownership

Name and Address of Beneficial Owner | Total Shares Beneficially Owned | Sole Voting and Investment Power | Shared Voting and Investment Power | Percent of Class | Name and Address of Beneficial Owner | Total Shares Beneficially Owned | Sole Voting and Investment Power | Shared Voting and Investment Power | Percent of Class | |||||||||||||||||||||||||||||

Hills Bank and Trust Company, as trustee of the Hills Bank and Trust Company Employee Stock Ownership Plan (the “ESOP”) 131 Main Street Hills, Iowa 52235 | 802,743 | — | 802,003 | (1) | 8.51 | % | Hills Bank and Trust Company, as trustee of the Hills Bank and Trust Company Employee Stock Ownership Plan (the “ESOP”) 131 Main Street Hills, Iowa 52235 | 708,856 | — | 708,856 | (1) | 7.68 | % | |||||||||||||||||||||||||

NOTE:

(1)Consists of shares of Company Common Stock allocated to the accounts of employees of the Bank who are eligible to participate in the ESOP. Employees are entitled to direct the trustee how to vote shares allocated to their accounts.

The following table sets forth as of March 2, 20183, 2023 the number of shares of the Company’s Common Stock beneficially owned by each Director, nominee for Director, the non-Director executive officers and all the Directors and the non-Director executive officers as a group. The Company has not adopted a share ownership policy or a share retention policy for the Directors or the executive officers.

Amount and Nature of Beneficial Ownership

| Name | Total Shares Beneficially Owned | Sole Voting and Investment Power | Shared Voting and Investment Power | Percent of Class (4) | ||||||||||||||||||||||

| Directors | ||||||||||||||||||||||||||

| Michael S. Donovan | 24,177 | 14,922 | 9,255 | 0.26 | % | |||||||||||||||||||||

| Kirsten H. Frey | 1,935 | (1) | 1,935 | — | 0.02 | % | ||||||||||||||||||||

| Michael E. Hodge | 24,905 | 15,815 | 9,090 | 0.27 | % | |||||||||||||||||||||

| Emily A. Hughes | 242,234 | (3) | 42,234 | 200,000 | 2.60 | % | ||||||||||||||||||||

| Casey L. Peck | 1,935 | (1) | 1,935 | — | 0.02 | % | ||||||||||||||||||||

| John W. Phelan | 16,398 | 11,951 | 4,447 | 0.18 | % | |||||||||||||||||||||

| Ann Marie Rhodes | 1,507 | 1,507 | — | 0.02 | % | |||||||||||||||||||||

| James C. Schmitt | 5,090 | (1) | 5,090 | — | 0.05 | % | ||||||||||||||||||||

| Dwight O. Seegmiller | 256,575 | (2) | 249,375 | 7,200 | 2.76 | % | ||||||||||||||||||||

| Thomas R. Wiele | 8,794 | 8,133 | 661 | 0.09 | % | |||||||||||||||||||||

| Sheldon E. Yoder, D.V.M. | 26,000 | 24,390 | 1,610 | 0.28 | % | |||||||||||||||||||||

| Non-Director Named Executive Officers | ||||||||||||||||||||||||||

| Lisa A. Shileny | 6,067 | (2) | 5,546 | 521 | 0.07 | % | ||||||||||||||||||||

| Timothy D. Finer | 36,563 | (2) | 36,563 | — | 0.39 | % | ||||||||||||||||||||

| Steven R. Ropp | 37,229 | (2) | 37,229 | — | 0.40 | % | ||||||||||||||||||||

| Anthony Roetlin | 825 | 825 | — | 0.01 | % | |||||||||||||||||||||

| All Directors and Non-Director Executive Officers as a Group (22 persons) | 723,401 | (2) | 489,616 | 233,785 | 7.78 | % | ||||||||||||||||||||

16

| Name | Total Shares Beneficially Owned | Sole Voting and Investment Power | Shared Voting and Investment Power | Percent of Class (4) | |||||||||

| Directors | |||||||||||||

| Michael S. Donovan | 22,512 | 13,294 | 9,218 | 0.24 | % | ||||||||

| Thomas J. Gill, D.D.S. | 20,256 | 20,256 | — | 0.21 | % | ||||||||

| Michael E. Hodge | 20,930 | 15,164 | 5,766 | 0.22 | % | ||||||||

| Emily A. Hughes | 242,234 | (1)(3) | 42,234 | 200,000 | 2.57 | % | |||||||

| James A. Nowak | 12,123 | 10,190 | 1,933 | 0.13 | % | ||||||||

| Theodore H. Pacha | 26,949 | 26,949 | — | 0.29 | % | ||||||||

| John W. Phelan | 12,460 | 8,210 | 4,250 | 0.13 | % | ||||||||

| Ann Marie Rhodes | 500 | 500 | — | 0.01 | % | ||||||||

| Dwight O. Seegmiller | 254,395 | (2) | 157,144 | 97,251 | 2.70 | % | |||||||

| Thomas R. Wiele | 5,338 | (1) | 4,844 | 494 | 0.06 | % | |||||||

| Sheldon E. Yoder, D.V.M. | 23,000 | 21,390 | 1,610 | 0.24 | % | ||||||||

| Non-Director Executive Officers | |||||||||||||

| Shari J. DeMaris | 12,920 | (1)(2) | 10,988 | 1,932 | 0.14 | % | |||||||

| Timothy D. Finer | 35,183 | (2) | 8,500 | 26,683 | 0.37 | % | |||||||

| Steven R. Ropp | 35,313 | (2) | 15,045 | 20,268 | 0.37 | % | |||||||

| Bradford C. Zuber | 42,292 | (2) | 12,826 | 29,466 | 0.45 | % | |||||||

| All Directors and Non-Director Executive Officers as a Group (15 persons) | 766,405 | (2) | 367,534 | 398,871 | 8.13 | % | |||||||

NOTES:

(1)This figure includes shares subject to currently exercisable stock options granted pursuant to the 2010 Stock Option and Incentive Plan. For Directors, the options will expire ten years after the grant date or two years after the Director’s term of service on the Board of Directors of the Company ends, whichever occurs first. For Non-Director Executive Officers, the options expire ten years after the grant date. Details of the stock options are as follows:

| Name | Grant Date | Number of Options | Exercise Price | Expiration Date | ||||||||||||||||||||||

| Kirsten H. Frey | 5/14/2019 | 1,935 | $ | 62.00 | 5/14/2029 | |||||||||||||||||||||

| Casey L. Peck | 5/14/2019 | 1,935 | 62.00 | 5/14/2029 | ||||||||||||||||||||||

| James C. Schmitt | 5/14/2019 | 1,935 | 62.00 | 5/14/2029 | ||||||||||||||||||||||

(2)This figure includes shares held by the Bank’s ESOP which have been allocated to the named executive officers for voting purposes as follows:

| Name | Grant Date | Number of Options | Exercise Price | Expiration Date | |||||||

| Shari J. DeMaris | 10/9/2012 | 3,000 | $ | 34.50 | 10/9/2022 | ||||||

| Emily A. Hughes | 4/24/2012 | 3,610 | 33.00 | 4/24/2022 | |||||||

| Thomas R.Wiele | 4/24/2012 | 3,610 | 33.00 | 4/24/2022 | |||||||

| Name | ESOP Shares | |||||||

| 1,992 | |||||

| 28,063 | ||||||||

| 21,362 | ||||||||

| Dwight O. Seegmiller | 92,231 | |||||||

(3)This figure includes 200,000 shares owned in a limited partnership of which Director Hughes is a general partner. Ms. Hughes has shared voting and investment power in the limited partnership.

(4)Includes, for each such person, shares that are deemed to be beneficially owned by such person (a) because such shares are subject to options currently exercisable by such person or (b) because such shares are held by the ESOP and have been allocated to such person with shared voting power, as described in Notes 1, 2 and 3.

Hedging Practices

The Company has not adopted any practice or policies regarding the ability of directors or employees (including officers), or their designees, to purchase financial instruments, or otherwise engage in transactions, that are designed to hedge or offset any decrease in the market value of the Company’s stock held by such insiders.

DELINQUENT SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEREPORTS

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s Directors, executive officers and persons who own more than 10 percent of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership of such securities with the Securities and Exchange Commission. Directors and executive officers and greater than 10 percent beneficial owners are required by applicable regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely upon a review of the copies of the forms furnished to the Company, or written representations from certain reporting persons that no other reports were required, the Company believes that all filing requirements applicable to the Directors and executive officers were complied with during 2017.2022.

COMPENSATION AND INCENTIVE STOCK COMMITTEE INTERLOCKS

AND CERTAIN OTHER TRANSACTIONSINSIDER PARTICIPATION

All compensation decisions affecting the executive officers of the Company and the Bank are made by the Compensation and Incentive Stock Committee of the Board of Directors consisting of the ten non-employee Directors (all Directors but Mr. Seegmiller). The Committee makes compensation decisions with respect to each of the Company Named Executive Officers identified in the Summary Compensation Table and other tables on the following pages of this Proxy Statement. The compensation paid to the Bank Named Executive Officers is not directly determined by the Committee, but is determined by Mr. Seegmiller, and Ms. DeMaris, as the senior executivesexecutive of the Company and the Bank, and Ms. Shileny, as President of the Bank, which determinations are then reviewed and ratified by the Committee.

17

Michael E. Hodge, in his capacity as a member of the Boards of Directors of the Company and the Bank and of the Compensation and Incentive Stock Committee, participated in deliberations concerning executive compensation matters during 2017.2022. Within

the last three fiscal years, the Bank has had certain business relationships with Hodge Construction Company, a general contractor. In addition, Mr. Hodge is a 17.65% investor in the limited liability corporation, OC Group, L.C. that is the owner of the Old Capitol Town Center, a portion of which is leased by the Bank for a bank office location, and he is a 38%30% owner of Corridor Commercial DevelopmentHodge Construction Company, ("Corridor"), from which the Bank purchased propertiesutilized construction management services in 2016.2022.

The Bank has an agreement with the OC Group, L.C. under which it leased 5,845 square feet of space in Old Capitol Town Center, a two-story building with a total of 99,612 square feet, located in downtown Iowa City. Mr. Hodge holds a 17.65% ownership interest in OC Group, L.C., the owner of Old Capitol Town Center. The ten-year lease began on June 1, 2004 and was extended in 20142019 until 2019,2024, the firstsecond renewal period under the lease. The lease term is subject to threetwo additional five-year renewal options. The Bank’s annual lease payment on this space is currently $23.28$25.54 per square foot and increases 2% per year, plus annual common area maintenance charges of $4.00 per square foot. The Bank is also responsible for payment of the real estate taxes allocated to the leased space. The annual lease cost in 20172022 was $152,388$165,258 before payment of such real estate taxes, which were $20,948$25,236 for the year. In the opinion of management, the cost of the leased space is similar to the cost of leasing comparable commercial property in downtown Iowa City.

The Board of Directors of the Bank does not believe that the participation by Mr. Hodge in the deliberations concerning executive compensation has provided the Company Named Executive Officers with more favorable compensation arrangements than would have been the case absent his participation in such deliberations. As disclosed elsewhere in this proxy statement under the caption "Corporate Governance and the Board of Directors," management has concluded that Mr. Hodge is not an independent Director as defined by NASDAQ's rules.

In addition, certain of the officers and Directors of the Company, their associates or members of their families, were customers of, and have had transactions with, the Bank from time to time in the ordinary course of business, and additional transactions may be expected to take place in the ordinary course of business in the future. Federal Reserve Regulation O requires loans made by the Bank to executive officers and Directors to be made on substantially the same terms, including interest rates and collateral, and following credit-underwriting procedures that are no less stringent than those prevailing at the time for other transactions by the Bank with other unrelated persons. Such loans may not involve more than the normal risk of repayment or present other unfavorable features. Regulation O also requires approval by the Board of Directors for all insider loans in excess of $500,000.

The Company does not have a formal written policy regarding the review and approval of transactions between the Company and its Directors, executive officers and other related interests. However, it is the general practice of the Board of Directors to review and approve any new non-loan transactions that would exceed $120,000.$120,000, with the interested Director recusing him- or herself from deliberations and voting on the proposal. In making a determination to approve a related party transaction the Board of Directors will take into account, among other factors it deems appropriate, whether the proposed transaction is on terms no less favorable to the Company than those generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related party’s interest in the proposed transaction. On a yearly basis, the Board of Directors reviews information on any existing and ongoing transactions with the Directors as disclosed under the Compensation and Incentive Stock Committee Interlocks and Certain Other Transactions with Executive Officers and DirectorsInsider Participation section. Management of the Company anticipates that the Bank and the Company will continue to maintain such business relationships in the future on a similar basis to the extent that such goods and services are required by the Bank and the Company.

No executive officer of the Company or Bank serves or has served as a member of the Board of Directors or the Compensation Committee of any other company which employs any member of the Company's Board of Directors.

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

In the following Compensation Discussion and Analysis section, the Company provides information concerning compensation and benefits provided to the two executive officers of the Company (the “Company Named Executive Officers”). The Company’s current Named Executive Officers are Dwight O. Seegmiller, who is the President and Principal Executive Officer (“PEO”) and Shari J. DeMaris,Anthony Roetlin, who joined the Company as Treasurer and PFO effective December 30, 2022. Joseph A. Schueller is the Secretary/former Treasurer and Principal Financial Officer (“PFO”). of the Company who resigned effective

18

September 2, 2022. In addition, information is provided concerning compensation and benefits provided to three executive officers of the Bank (the “Bank Named Executive Officers”). The Bank executive officers are Timothy D. Finer, Senior Vice President and Director of Real Estate Lending, Steven R. Ropp, Senior Vice President and Director of Commercial Banking, and Bradford C. Zuber, Senior ViceLisa A. Shileny, President and Director of Trust Services.Chief Operating Officer.

The Company’s overall compensation objectives are to pay salaries and provide benefits that are both fair and reasonable, consistent with the compensation practices of the financial services industry in general, and appropriate and competitive in the Bank’s local marketplace. The Company’s goal is to attract, develop and retain high caliber executives who are capable of increasing the Company’s performance for the benefit of its shareholders while maintaining the philosophy of community banking. Ultimately, the Company desires to base its compensation on individual performance as it affects the overall financial results of the Company. Specifically, the executive compensation program of the Company has been designed to:

•provide a pay-for-performance policy that differentiates compensation amounts based upon corporate and individual performance;

•provide compensation opportunities comparable to those offered by other Iowa-based financial institutions and Midwest banks of similar asset size, thus allowing the Bank to compete for and retain talented executives who are essential to the long-term success of the Company and the Bank;

•align the interest of the officers with the long-term interest of the Company’s shareholders through the ownership of Company Common Stock; and

•maintain a corporate environment which encourages stability and long-term focus for the primary constituencies of the Company, including shareholders, employees, customers, regulatory agencies and the communities it serves.

To achieve its objectives the Company has structured it’sits compensation program: (1) to reward current corporate and individual performance through salary increases and opportunities for cash bonuses; and (2) to reward long-term corporate and individual performance through participation in the ESOP and Profit Sharing Plan, the Deferred Compensation Plan and participation in the Incentive Stock Plan. The amounts and types of compensation paid in 20172022 (as set forth below) fit into the Company’s overall compensation objectives by achieving those two objectives.

Decisions Regarding Composition of Total Compensation

The Compensation and Incentive Stock Committee (the “Committee”), which is comprised of the full Board of Directors with the exception of Director Seegmiller, has responsibility for implementing and overseeing the Company’s executive compensation program. In this respect, the Committee has strategic and administrative responsibility for a broad range of issues, including ensuring that the Company compensates key management employees effectively and in a manner consistent with the Company’s compensation strategy. The Committee also oversees the administration of executive compensation plans, including the design, performance measures, and award opportunities for management compensation programs, and certain employee benefits. The Committee also makes compensation decisions with respect to each of the Company Named Executive Officers identified in the Summary Compensation Table and other tables on the following pages of this Proxy Statement. The compensation paid to the Bank Named Executive Officers is not directly determined by the Committee, but is determined by Mr. Seegmiller, and Ms. DeMaris, as the senior executivesexecutive of the Company and the Bank, and Ms. Shileny, as the President of the Bank, which determinations are then reviewed and ratified by the Committee.

The Committee’s policy is to review management compensation at least annually. The Committee makes these reviews to ensure that management compensation is consistent with the Company’s compensation philosophies articulated above.

The factors the Committee considers in either determining or ratifying, as the case may be, the level and composition of compensation include but are not limited to the following: (1) the Bank’s performance as compared to internally-established goals for the most recently ended fiscal year and to the performance of other Iowa-based financial institutions; (2) the individual officer’s level of responsibility within the Bank; and (3) competitive compensation data. In addition, the Committee considers the financial performance for the current year including the business plan containing the financial performance goals measured primarily in terms of earnings per share, growth of the Company, asset quality, return on assets and return on stockholders’ equity. The Committee also considers the financial budget for the upcoming fiscal year and the Company’s updated strategic plan. While the foregoing factors are not specifically weighted in the decision-making process, primary emphasis is placed on the Bank’s performance during the previous year as compared to the internally-established goals. Although the Committee reviewed a number of objective factors in setting compensation for 2017,2022, its final decision was based on a subjective determination. Details regarding the compensation of each of the Company and Bank Named Executive Officers are set forth in the tables that appear below.

19

The internally established goals for purposes of the compensation discussion focus on the financial budget for the year under review compared to the actual results. However, there are no predetermined increases or decreases in the compensation based solely upon the financial results in terms of net income compared to the budget. Any significant variance to the budget is analyzed fully with the Board of Directors to determine the reasons behind the variance and to determine if such variance is a result of

management’s efforts or is driven by factors in the financial area outside of their control. Compensation adjustments are not made based on any predetermined formulas of the financial performance goals established during the financial budget process.

The Committee has not engaged outside consultants, but that option is available to the Committee. However, in evaluating the salary component of the compensation of the Company and Bank Named Executive OfficerOfficers each year, the Committee reviews salaries paid to officers holding similar positions in other Iowa-based financial institutions and compensation data from SNL Financial concerning salaries paid by other Midwest banks having between $1 billion and $3 billion in assets. The Committee also reviews compensation data from the Iowa Bankers’ Association.institutions. The companies included in the peer group are reviewed annually and may change based on size, merger and acquisition activity and other pertinent factors. Review of this information is done primarily to determine that the salarysalaries established isare at a competitive level. The Committee does not set strict parameters using this data. Rather, the Committee uses this data to ensure that the Company and Bank Named Executive Officer’sOfficers' compensation paid by the Bank is not inconsistent with compensation levels at appropriately defined peer organizations.

In determining the compensation to be paid to the Company Named Executive Officers in 2017,2022, the Committee took the actions listed below:

•Reviewed the financial performance of the Company based on a comparison of actual net income to budgeted and prior year net income;

•Reviewed leadership and quality of contribution to the strategic direction of the Company;

•Reviewed peer performance data versus the Company and discussed goals for 20172022 and beyond;

•Reviewed overall contributions by the Company to the communities it serves;

•Reviewed contributions to the management of the Company’s employees and daily operations, the administration of the Company’s policies and procedures and enhancement of long-term relationships with customers;

•Reviewed the current total compensation package for the Company Named Executive Officers to determine market competitiveness;

•Performed an evaluation of Mr. Seegmiller; and